Whether you are just starting a new company, expanding your operations, evaluating a new market, product or service, or buying an existing business, we can help you plan your next project.

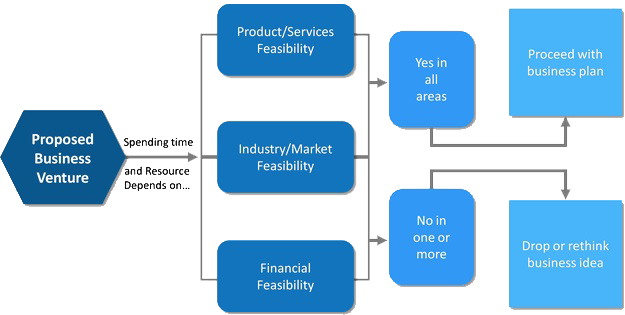

Starting any project or venture is a massive risk, and failure is common. Fortunately, there is a way to pre-check the potential success of a new project called a feasibility study

A feasibility study aims to objectively and rationally uncover the strengths and weaknesses of an existing business or proposed venture, opportunities and threats present in the environment, the resources required to carry through, and ultimately the prospects for success

Feasibility study is one of the important steps in business management. It is a step-by-step approach to the overall functioning of a business project, weighing the pros and cons of each stage of BEFORE before getting into the actual process.

A feasibility study helps answer the following questions:

* Is the project feasible?

* Can it be done? Does it make sense? Should we proceed with the proposed project idea?

* Does it make sense?

* Should we proceed with the proposed project idea?

A feasibility study should be conducted to determine the viability of an idea BEFORE proceeding with the development of a business.

This activity takes place during the project initiation phase and is conducted before the project is implemented.

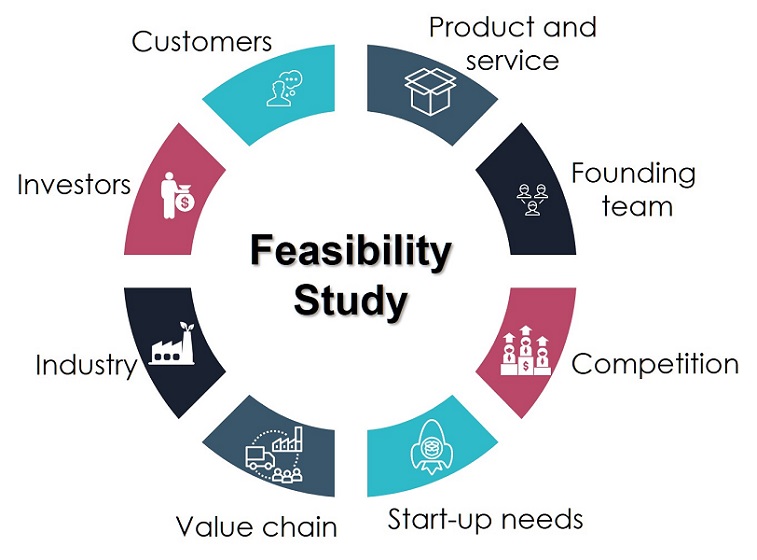

The study needs inputs from many professional disciplines from various areas of the study

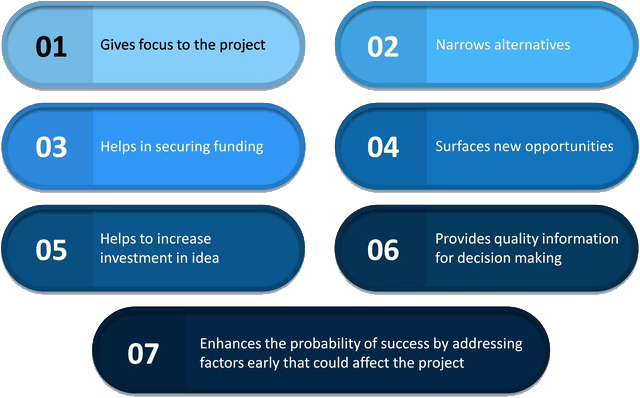

Provides a thorough examination of all factors of business success

Gives focus to the project and outline alternatives

Provides quality information for decision making

Narrows business alternatives

Detects new opportunities through the investigative process

Identify reasons NOT to proceed

Lists the reasons to undertake the project

Develops marketing strategies to convince banks or investors that the project is worth considering as an investment

Provides documentation that the project was thoroughly investigated, emphasizing potential problems and defining internal and external project constraints

Serves as a solid foundation for developing the business plan

The Feasibility Study is a critical step in the assessment process

Helps to improves the probability of success by addressing as well as mitigating risk elements

A key factor in any Feasibility Study must be to ensure that we are dealing with correct facts, correct assumptions and know up to date financial data.

Many projects fail because of incorrect assumptions or because assumptions were based on incorrect facts.

Data required for the feasibility study would come from primary and secondary sources

*Primary data will include formal interviews

*Secondary data will include industry and trade publications, statistics of industry associations, government , and international institutions reports

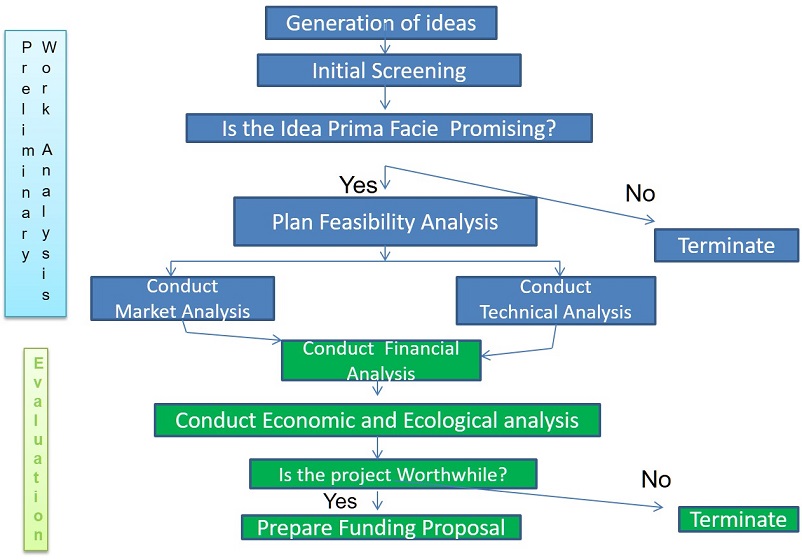

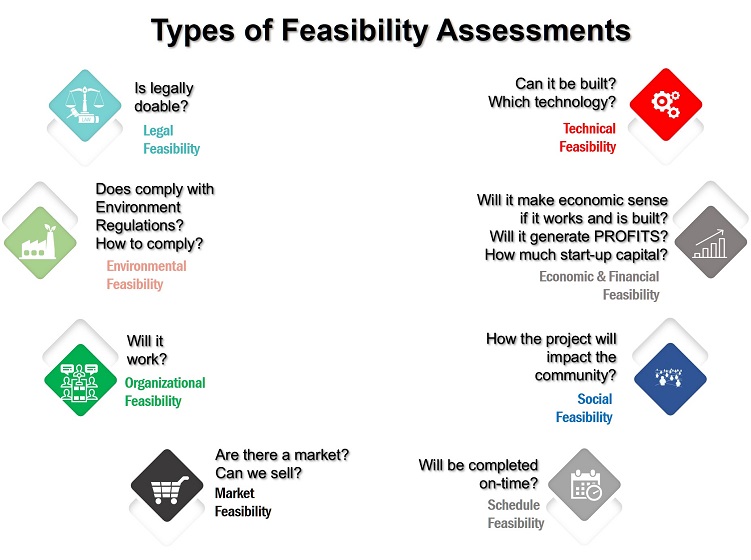

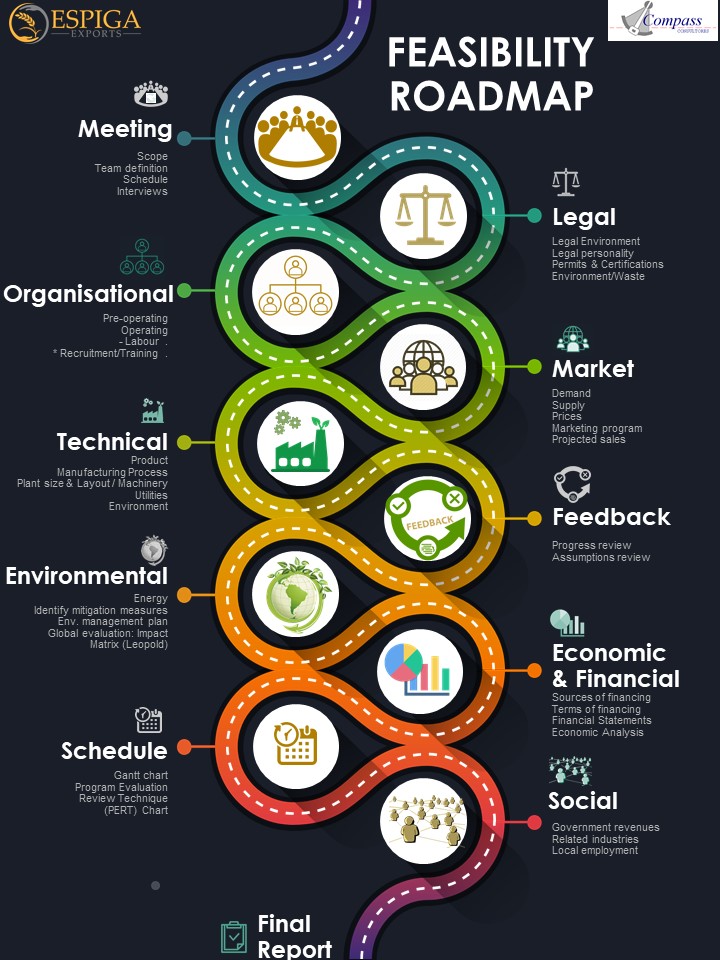

A feasibility study of a project is conducted at several levels

Please check mor einformation in our Internationalization section.

The analysis will indicate the risks and obstacles that need to be addressed within the technical, economic and financial feasibilities.

The main objectives of the legal feasibility analysis are as follows:

This is a measure of how well a proposed project could have a success and takes advantage of the opportunities, identified during scope definition. It also measures how the proposed project satisfies the requirements identified in the analysis phase.

Market Feasibility provides important information to identify and analyse the market need, market size and competition.

We can set up the goals of the market feasibility study as follows:

Infrastructure projects will often have significant environmental impacts arising from construction and operation, which can be both positive and negative. The impacts may also include follow-on effects beyond the immediate project area, as well as beyond the people directly associated with the project (secondary impacts).

These impacts (including secondary impacts), and the corresponding formal process of approvals (which varies enormously from country to country), are a common source of delays for projects.

The mitigation strategies for environmental risks imposed by approving agencies are also a significant component of project costs that can reduce the expected return on investment or impact directly on the governmental liabilities, depending on the risk allocation regime.

Thus, an effective evaluation of the environmental issues and a structured recommendation about the project's environmental feasibility is a very important output of the Appraisal Phase.

The main purpose of a comprehensive assessment of environmental issues is to ensure that environmental considerations are explicitly addressed and incorporated into the green light decision, and that there are no unmanageable environmental obstacles ahead of the project. This allows anticipating, avoiding, minimizing, or offsetting the adverse significant bio-physical effects of the infrastructure. It is also very relevant that all the measures required for the environmental approvals be taken to prevent unnecessary delays in the project schedule.

The project will:

For more information visit the Environmental Impact Assessment section.

Economic analysis is the most frequently used method for evaluating the effectiveness of a project. More commonly known as cost/benefit analysis, the procedure is to determine the benefits and savings that are expected from a candidate project and compare them with the costs. If benefits outweigh costs, then the decision is made to design and implement the system. A company must accurately weigh the costs versus benefits before taking an action.

The Economic & Financial Feasibility will be prepare under various production, price and sales levels. This may involve identifying "best case", "typical", and "worst case" scenarios. As well as different global economic scenarios.

Estimate Expected Costs, Revenues, Profit Margin, Net Profit to generate Financial statements (Balance Sheet, Income Statement, Cash Flow Statement & Operating Budget)

Perform Break-Even Analysis

Estimate rate of returns under various production, price and sales levels to create a "sensitivity analysis"

Identify limitations or constraints of the economic analysis

Project expected Financial statements during the start-up period and when reaching full operation

Cost Benefits Analysis such as Net Present Value (NPV), Internal Rate of Return (IRR) and Benefit Cost Ratio (B/C Ratio)

Estimating Total Capital Requirements

Equity and Credit Needs

Projects can bring various societal benefits when planned responsibly. To ensure this is the case, Espiga Exports will ask the following questions:

Espiga Exports will :

Considering the current global demand and the benefits that brings Mexico's network of Free Trade Agreements is recommended that the project will be develop in a short time period considering that a project takes some time to be completed before it is completely operating. Typically we must estimate how long the project will take to develop, and if it can be completed in a given time period using some methods like payback period. Schedule feasibility is a measure of how reasonable the project timetable is. Given our technical expertise will be analyse if the project deadlines are reasonable.

Schedule feasibility is a measure of how reasonable the project timetable is. Typically we must estimate how long the project will take to develop, and whether it can be completed in a given time period using methods like payback periods.

Completing a project on time is very important from an investors perspective. Scheduling feasibility is a measure of how reasonable the project duration is. If the project takes longer than estimated, investors will have to bear extra costs and will affect the rentability of the project.

A feasibility study is designed to discover if a business is "feasible" or not. It will answer questions such as "will the project work?"

It is an essential first step before spending money and time on more detailed plans. The information gathered is not wasted as it can be incorporated into the Business Plan

A Business Plan is a more detailed and in depth document that incorporates the information gained from a Feasibility Study plus specific timelines, detailed budgets with forecasts and a detailed financial strategy

Business plan is prepared only after the project has been deemed to be feasible

Business plan deals with only one alternative or scenario that is determined to be the "best" alternative

Business plan considers the management side-goals and objectives

Espiga Exports has the experience in making feasibility studies tailored to your needs, it could be covering all the levels of Feasibility or just some of them depending your needs and resources.

Espiga Exports has the experience in making feasibility studies tailored to your needs, it could be covering all the levels of Feasibility or just some of them depending your needs and resources.

We are ready to exceed your expectations and help you achieve your goals.